Most Volatile Currency Pairs and How to Trade Them

Contents:

The synthetic deal entails the corporates paying the interest and repaying the loan principal in yen. If the client has no open position & is not trading for more than 6 months then the account will be treated as inactive & will be suspended from trading. The document states the risk in trading and Investors’ rights and obligations as per the model format specified by SEBI. Applicant should have clearly read and understood both the documents before signing the same. This form is designed to capture the personal information of the client e.g. identity, PAN number, address, bank details for registration of the client in the Currency Derivatives segment of the Exchange.

- Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate.

- After the data is displayed, click on a pair to see its average daily volatility, its average hourly volatility, and a breakdown of the pair’s volatility by day of the week.

- It is very similar to debit or credit card that you carry in your bag.

- This leads to increased risk when trading currency pairs with high volatility.

While most feel that yen may have touched a high, they dont rule out the possibility of the currency gaining a little more. The last time several companies found themselves in a similar situation was in March when the yen breached 100 per dollar. Compared with last time, fewer companies would be affected this time. For some the derivatives were also restructured to 90, said a banker. The impact will be less on companies which have bought European options.

International

The exchange rates are affected by several factors, thus making it difficult to predict. It is the price quote of the exchange rate for two different currencies traded in Forex markets. The actual exchange of a currency pair that occurs at the precise moment the deal is finalized – i.e. “on the spot” – or within a short period of time. These corporates, with yen exposures, had bought protections at 90 yen a dollar to reduce the risk arising out of a rising yen. Under the contracts (better known as American knock-out options) they had entered with the banks, the protection will disappear once the yen touches 90.

Its average daily turnover amounted to $6,6 trillion in 2019 ($1.9 trillion in 2004). Forex is based on free currency conversion, which means there is no government interference in exchange operations. Political and economic conditions have a significant impact on the exchange rate. The volatility of a particular currency can be considered either high or low.

In stock market, investors speculate about gaining profit without having strong evidence about it. Due to this speculation investors demand more with the expectation of returns. Changes in Interest Rates effects the currency value and dollar exchange rate. Forex rates, interest rates and inflation all the three terms have correlation with each other. A lot would depend on how long and how fast the yen carry trades would get unwound. Carry trades are transactions where international investors borrow yen, convert it into dollar to bet on stocks across markets.

India meets the lion’s share of its oil requirement through imports. Higher crude oil prices widen India’s current account deficit and in turn weighs on the rupee. Window forwards are a type of forward contract that offers more flexibility. Like a fixed forward contract, they let consumers lock in a beneficial exchange rate ahead of time. But while fixed forward contracts commit consumers to buy or sell a set amount of currency on a specific date, window forwards let them buy or sell over a set period. Significant volatility witnessed in Turkey and Venezuelan currencies during 2018 is a case in point that market participants should take care.

To minimise the risk of the blow, policymakers are struggling to stabilise their currencies. Vietnam’s central bank unexpectedly raised interest rates by another 1 percentage point for a second straight month in October to help ease pressure on its currency. The dong lost 9 per cent against the dollar in 2022 and fell to a 29-year low3. Meanwhile, the Japanese yen has fallen to a 32-year low against the dollar this year, prompting the government to step in to support its currency for the first time since 1998. The yen fell to the lower 149 zone against the US dollar in October. Similarly in China, the yuan lost more than 12 per cent on a year-to-date basis at October end, making it one of the weaker performing currencies in Asia, and was also trading lowest since 2007.

What is Forex trading?

Which leads to fewer job openings and the local economy will have less room to develop. Foreign exchange markets are essential for the functioning of the international economy. However, sometimes they seem overly unstable, and sometimes their movements are destructive. When the Fed Rates are high you can expect higher yields on US Bonds.

China Stock Market to Remain Volatile Near Term: BofA Securities – Bloomberg

China Stock Market to Remain Volatile Near Term: BofA Securities.

Posted: Fri, 28 Apr 2023 01:50:00 GMT [source]

It’s very simple, currency pair consists of two different currencies, the first of which is called the base currency, and the second is the quote currency, and looks like this – USD/EUR. When a trader is executing forex trade orders that means that he buys the base currency and sells the quoted currency at the same time. A sell order would be performed by selling the base currency and buying the quoted currency. Forex market trading happens at International Level that allows trading in different currencies like INR, EUR, JPY, and GBP. One is known as base currency and the other is known as quotation currency.

Comparison With Financial Crisis:

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. Sign up for a weekly brief collating many news items into one untangled thought delivered straight to your mailbox. Wood also said that he expects the reserves to recover moderately to around $600 billion by the end of this year, and remain relatively flat over the next few years.

Generally stocks of mid and small cap companies, with market capitalisation of less than Rs 25,000 crore qualifies as volatile stocks. FX markets are susceptible to a range of factors which affect their volatility, and many traders look to tailor their strategies to capitalize on the most volatile currency pairs. In general, trading volatile currency pairs requires a high degree of discipline and risk management.

Though many banks offer a 0% fee, it is not practical and one should understand that the fee may be in some other hidden form in such cases. In summary, this is NOT a book for people who know nothing about options trading. You should really have a firm background in options and options trading so that you can evaluate this information intelligently.

However, the outstanding positions would be in Pound Sterling terms. To prevent carriers from having to face the negative effects of fluctuating currency rates on freight costs alone, CAF was created. If Mr Bajaj went with the first option, he would have lost almost all his money by the end of the trade as the GBP/INR fell 0.73 paise in the day. Forex trading is typically done through a broker or market maker who facilitates the trades. Traders can use a variety of tools and techniques to analyze the market and make informed trading decisions. Though primarily this program is targeted towards the buy side participants, e.g., corporate but the sell side participants like banks who design, structure and sell such products would be equally benefitted.

Again, chances of you being able to consistently find a trade that far away is pretty slim. Currencies with high volatility are more prone to slippage than currency pairs with low volatility. Awareness of volatility can also help traders determine appropriate levels for stop loss and take profit limit orders. Furthermore, it is important to understand the key characteristics separating the most volatile currencies from currencies with low volatility readings. Traders should also know how to measure volatility and have an awareness of events that might create big changes in volatility.

Advantages of Zero Brokerage Trading

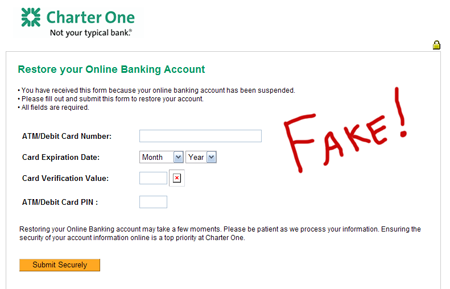

This is to inform that, many instances were reported by general public where fraudsters are cheating general public by misusing our brand name Motilal Oswal. The fraudsters are luring the general public to transfer them money by falsely committing attractive brokerage / investment schemes of share market and/or Mutual Funds and/or personal loan facilities. Though we have filed complaint with police for the safety of your money we request you to not fall prey to such fraudsters. You can check about our products and services by visiting our website You can also write to us at , to know more about products and services. The average true range for USD/CHF is between 45 and 65 pips, which is a modest average true range when compared to other pairings. The average true range of a currency is one of several measures to assess a currency pair’s volatility.

Euro Tipped For Further Gains Against The Dollar, Pound Sterling Say Currency Strategists – Exchange Rates UK

Euro Tipped For Further Gains Against The Dollar, Pound Sterling Say Currency Strategists.

Posted: Thu, 27 Apr 2023 10:11:00 GMT [source]

This also saves https://1investing.in/ by avoiding unnecessary intermediary steps like currency conversion and transfer. The greater the degree of risk, the greater the amount of currency rate volatility, and vice versa. On average, various currency pairings have varied amounts of volatility. Some traders prefer trading volatile currency pairings because of the larger potential gains.

Expected to be volatile stocks – Stocks that are stable now, but are expected to show greater volatility in the near term. The central bank has been intervening to hold the Rupee up against the dollar, by spending around $70 billion, this year. Almost $50 billion of this was released towards net spot sales, “but RBI appears unbowed” according to Mecklai. Less often traded, they frequently pit major currencies against each other rather than the US dollar.

Secondly, the author recommends selling options 2 standard deviations from the underlying’s current price. Good luck finding a liquid option that far away from the underlying’s price. And, if you do, you will have to buy numerous contracts because you’d be lucky to get a dime for the spread.

Establishing early payment terms is the simplest way for protection from exchange rate fluctuations in the international market. If customers do not respond well to immediate payment terms, introducing early payment discounts will encourage them to take the option. Discounts or other incentives, like credit towards future purchases, give customers a financial reason to pay early.

Some 6 important factors that influence the demand of enjoy the higher potential rewards that come with trading volatile currency pairs. Although, this increased potential reward does present a greater risk, so traders should consider reducing their position sizes when trading highly volatile currency pairs. Volatile stocks are highly popular among traders as they offer lucrative trading opportunities.

The relationship between foreign exchange rate volatility and export depends on the marketplace. For understanding the effects of exchange rates on an industry, it is necessary to see whether what is used for production is domestically produced or imported. A volatile exchange rate impacts exports if the industry has elements that are imported from abroad and are not produced within the country. With most of the transactions occurring in the main currency, this account prevents loss in the form of spread and protects the firm’s revenue from the volatile currency exchange rates. Also, one can always take credit in the main currency by maintaining a bank account operating in that currency.

Mr Bajaj decides to become rich by intraday trading in the GBP/INR futures. He decides to buy 13 lots against Rs 10,000 straight into his trading account. But he notices that the GBP/INR starts depreciating, and he worries about losing his money. Observing the market before investing is an essential step for successful forex trading especially if you are new. The Forex market is prone to fluctuations based on geopolitical tensions and other factors.