Financial Sector Definition, Role and Types

They are responsible for settling accounts between various participants in a market. They are common in the derivatives market, where many contracts are cash-settled, i.e., one party pays the other based on the price of the underlying security. It is the job of the clearing house to assign the payer, receiver, and amount of payment. The Treasury Department is the executive agency responsible for promoting economic prosperity and ensuring the financial security of the United States. The Italian insurance supervisor requested support to further enhance its market conduct supervision. The Commission supports supervisors across the EU to design and implement various parts of Solvency II, the well-known regulatory regime for insurance undertakings.

Personal finance is an individual’s budgeting, saving, and spending of monetary resources, like income, over time–while taking into consideration various monthly payments or future life events. It sets consumers up for all stages and major events in life, from buying their first car to retirement planning. For the most part, financial institutions act as a go-between, taking money from savers (such as deposits) and lending it to borrowers (which can include anybody from homes to enterprises to governments). Her topics of expertise include futures and options trading strategies, stock analysis, and personal finance. A specific method of implementing monetary policy is known as quantitative easing (QE). Under QE, the central bank purchases high-quality securities from banks in exchange for cash.

Products

The cash is then used to meet the regulatory reserves and for increased lending and investment. Investment managers are professional firms that provide investment management services to individual and institutional clients. They include a variety of players, such as mutual fund and exchange-traded fund (ETF) managers and hedge funds. Retail banks are the classic deposit-taking institutions that accept cash deposits from savers and pay interest on those savings.

In the 1970s, money began to gain more weight in the economy, causing economists to focus more on determining which assets to include or exclude from the money supply. While these large companies dominate the sector, there are other, smaller companies that participate in the sector as well. Insurers are also a major industry within the financial sector, being made up of such companies as American International Group (AIG) and Chubb (CB). To counter the effects of an economic depression, central banks use expansionary monetary policy.

Financial Services Industry Analysis

The bank earns the differential between the interest paid on deposits and the interest earned from loans. Some well-known examples of retail banks worldwide are Bank of America, Royal Bank of Canada, BNP Paribas, Mitsubishi UFJ, and HDFC Bank. Revision of INR.18 to clarify the requirements on sharing of information related to unusual or suspicious transactions within financial groups. It also includes providing this information to branches and subsidiaries when necessary for AML/CFT risk management. What is the objective of anti-money laundering, counter terrorist and counter proliferation financing efforts?

Some commercial banks began investing in derivatives, such as mortgage-backed securities. Regulatory bodies are interconnected with various industries, and financial services is no exception. Independent agencies are designated to oversee different financial institutions’ operations, uphold transparency, and ensure their clients are treated fairly.

What are the 4 main types of financial institutions?

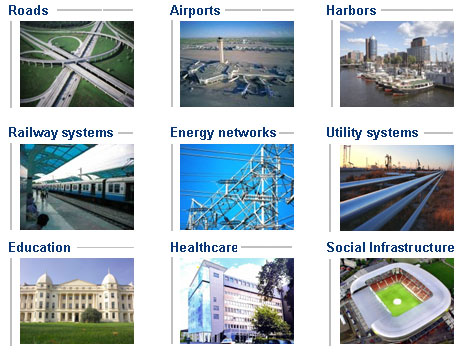

For businesses, they provide products like marine insurance for goods on ships, data breach insurance, worker’s compensation insurance, etc. Payment processors generate revenue by charging a small fee on every transaction that is routed through their network. Examples of payment processors financial sector meaning include Visa, MasterCard, Interac, and American Express. These are venues where the actual trading of financial assets takes place. Each Sector Risk Management Agency develops a sector-specific plan through a coordinated effort involving its public and private sector partners.

- Find out more about the various components that governments must implement, and that the FATF will assess against.

- Economists often tie the overall health of the economy with the health of the financial sector.

- Banks are a safe place to deposit excess cash, and to manage money through products like savings accounts, certificates of deposit, and checking accounts.

- The Gramm–Leach–Bliley Act of the late 1990s was a major factor in the rise of the phrase “financial services” in the United States, as it allowed diverse types of financial services corporations to consolidate.

- They also offer other services like prime brokerage, which are brokerage services like securities lending to large institutional clients.

Large-scale power outages, recent natural disasters, and an increase in the number and sophistication of cyberattacks demonstrate the wide range of potential risks facing the sector. This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Financial Services Industry Regulations

Revision of R.25 and the Glossary definitions of “beneficial owner”, “beneficiary” and “legal arrangements”, to strengthen the standards on beneficial ownership of legal arrangements. Revision of R.24 and the Glossary definition.\r\nAddition of new definitions “nominator” and “nominee shareholder or director”, to strengthen the standards on beneficial ownership of legal persons. Insertion of an Interpretive Note that sets out the application of the FATF Standards to virtual asset activities and service providers. Revision of R.15 and addition of new definitions “virtual asset” and “virtual asset service provider” in order to clarify how AML/CFT requirements apply in the context of virtual assets. The Financial Services Sector represents a vital component of our nation’s critical infrastructure.

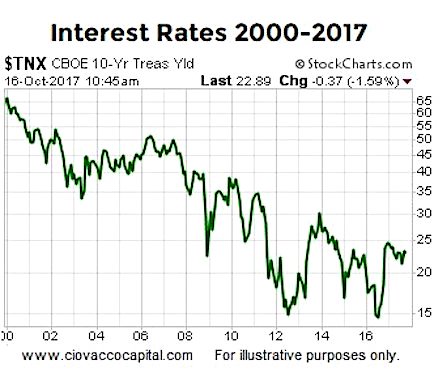

The New York Fed President Sees Interest Rates Coming Down … – The New York Times

The New York Fed President Sees Interest Rates Coming Down ….

Posted: Mon, 07 Aug 2023 09:00:21 GMT [source]

You probably don’t know it, but you have been involved in the financial sector from an early age. You have been participating in it since the first time you bought something in a shop in exchange for cash. The financial services sector or the financial sector provides financing solutions for individuals, firms, and governments, which in turn contributes to economic stability and growth. Let’s find out what the financial sector really is and what specific function it serves. Companies and institutions that supply commercial and retail consumers with financial services make up the financial industry. Interest rates fall, which increases the value of mortgages and other loans, which in turn boosts this sector’s earnings.

Investment Banking

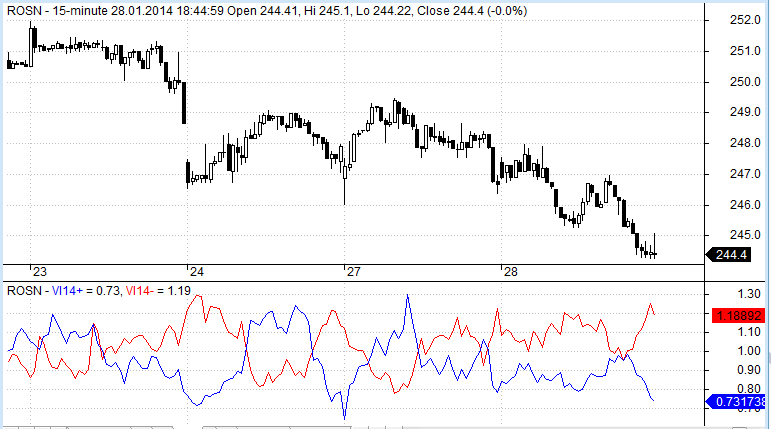

The sector has underperformed the S&P 500 index in the trailing 12 months (TTM), where the S&P 500 is up 14.3% while the S&P 500 Financials Sector has fallen 13.7%. There are also reinsurance companies that provide insurance to insurance companies. They help cover an insurance firm’s liabilities in case of a major disaster. Examples of insurance companies include Manulife and MunichRe (reinsurance). In the case of individuals, they provide products like life insurance, health insurance, auto insurance, and house insurance.

These efforts improve financial stability and enhance the role of the insurance and pension funds industry in funding our economy in a sustainable way. Information about real GDP or GDP growth rates are forms of lag indicators, as they provide information on the current and past state of the macroeconomy. Let’s now take a closer look at the impact of Brexit for businesses in the UK financial sector. Brexit is the withdrawal of the UK from the European Union after 47 years of membership.

To help businesses grow, this sector lends money, grants mortgages to homeowners, and provides insurance policies to safeguard individuals, businesses, and their property. Saving for retirement and employing millions of people are both benefits of this. It is common for individuals to think of Wall Street and the financial markets as being synonymous with the financial sector. Brokers, financial institutions, and money markets all play a role in keeping Main Street running smoothly on a daily basis. The role of the financial sector is to provide financial services for individuals and businesses.

Financial development

The Commission helps EU Member States remove barriers at national level that stand between investors’ capital and investment opportunities. It provides technical support in collaboration with the Directorate-General for Financial Stability, Financial Services and Capital Markets Union. The financial services sector is the part of an economy that supports the trading of financial instruments such as stocks, bonds, foreign currency, insurance and commodities. It also regulates the balance of supply and demand of money by lending money from private savings to those in need. Many people equate the financial sector with Wall Street and the exchanges that operate on it.

- A finance firm, in contrast to a bank, does not accept customer deposits in cash and does not provide some services that banks often offer, such as checking or savings accounts.

- Banking and investing apps continue to grow in popularity and may mean you never have to visit a brick-and-mortar bank at all.

- A specific method of implementing monetary policy is known as quantitative easing (QE).

- Supply-side policies are policies that aim to increase productivity and efficiency in the economy.

There are a multitude of stakeholders and moving parts within financial services, from credit card issuers and processors, to legacy banks and emerging challengers. The Capital Markets Union is an economic policy initiative that aims to further develop and integrate EU capital markets. The goal of the Capital Markets Union is to promote cross-country risk sharing and to enable companies and projects to obtain diverse funding, regardless of their location in the EU.